Stefon Walters, The Motley Fool

5 min read

In This Article:

-

Coca-Cola has increased its annual dividend for 63 consecutive years.

-

Pricing power allows Coca-Cola to offset periods of declining or stagnant shipping volume by increasing prices.

-

Coca-Cola trimmed its portfolio by nearly half to focus on operational efficiency.

It's easy to focus on stocks' price movements because it's the most straightforward way to measure performance. However, a lot of money can be made from stocks beyond just price appreciation. The key is dividends.

Dividends are a way for companies to reward shareholders for simply owning a stock and can compensate for slow (or no) stock price growth. Ideally, you'll get both stock price growth and dividends, creating a lucrative two-for-one.

There are thousands of dividend stocks on the market, but they're not all created equal. There are dozens that I think highly of, but if I had to choose only one to invest in, it would be Coca-Cola (NYSE: KO).

When it comes to dividend security, you'd have a hard time finding a more reliable stock than Coca-Cola. It has paid out a dividend since 1920, but more importantly, it has increased its annual dividend for 63 consecutive years. Only eight companies on the stock market have a longer streak.

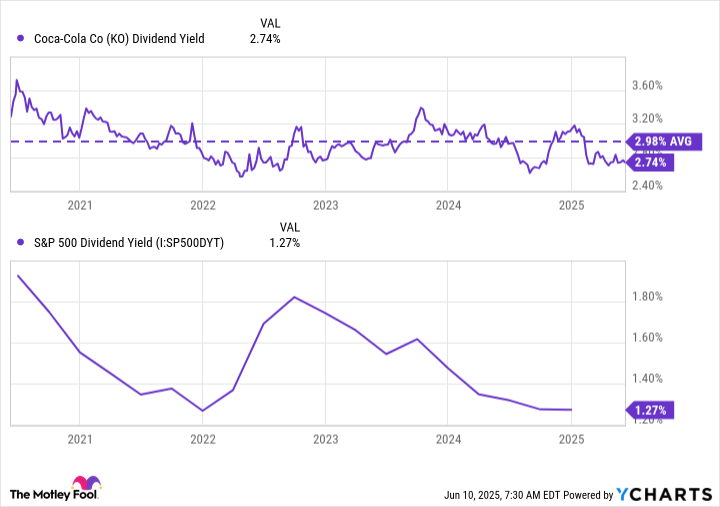

Coca-Cola's current quarterly dividend is $0.51, with a yield of around 2.7% (as of June 10). It's not an ultra-high yield that other S&P 500 stocks may have, but it's still more than double the current S&P 500 average.

Coca-Cola's dividend yield is lower than usual because its stock price has had an impressive start to 2025, up over 17%. This hasn't been the recent norm for Coca-Cola's stock, but it's a nice addition to its dividend.

Coca-Cola is as close to a recession-proof business as you'll find on the market, and it comes down to two things: products that sell no matter what and pricing power.

Coca-Cola products are considered consumer staples, meaning they're everyday items that people purchase regardless of economic conditions. When money is tight, consumers typically delay upgrading electronics, put off vacations, or cook at home instead of dining out at restaurants. What they don't typically remove from the budget are Coca-Cola products.

This doesn't mean Coca-Cola doesn't face headwinds or slowdowns; it absolutely does. However, it does mean its core business remains relatively stable through economic downturns. And when volume slows down, Coca-Cola has the pricing power to increase prices without losing customers.