Quentin Fottrell

5 min read

Without going into details of my spouse’s financial infidelity, I would like your opinion. Here is the bottom line. I’m 68 and my 401(k) has dwindled to $82,000. I have $3,000 in gold and Social Security income for me and my spouse totals $46,180 a year.

Our home is paid off and the estimated value is somewhere between $600,000 and $1 million. We live in a vacation area. Many out-of-state folks have moved in and the price of even a tiny home is outrageous right now. Yearly land taxes at $5,000.

-

Israel-Iran clash delivers a fresh shock to investors. History suggests this is the move to make.

-

I’m in my 80s and have 2 kids. How do I choose between them to be my executor?

Our adult children owe us a total of $90,000 and are attempting monthly payments of various amounts. My spouse has $50,000 in credit-card debt. I abhor any debt. What is the smartest way to pay off this debt?

Feeling Desperate

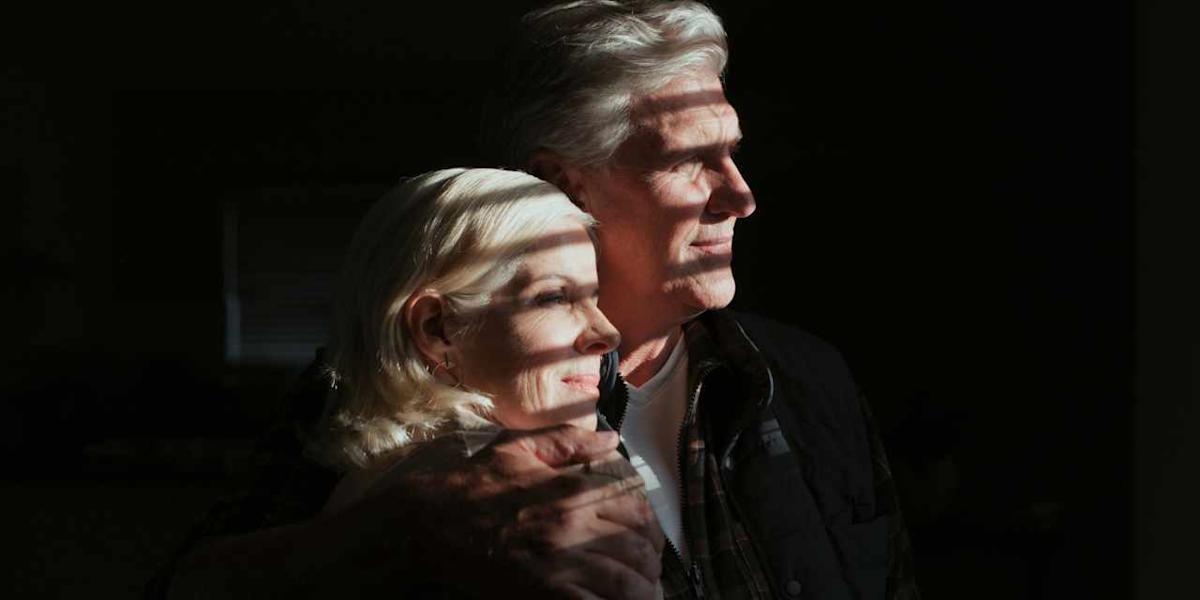

Financial infidelity — keeping secrets like excessive spending a secret — can be as damaging as more traditional infidelity.

Your children could pay off your credit-card debt, almost twice over, if they were able to stick to a payment plan. But lending money to people — children, friends, neighbors, relatives — who have gotten themselves into the red won’t necessarily solve their problem. It will merely create a problem for more parties: the lender, who wonders why the money was never repaid in a years-long game of cat-and-mouse, and the borrower, who has added creditor to their list.

The smartest way to pay off your debt is to write all your expenses in one column and your income in another and create your own personal Department of Good Housekeeping. Slash and burn and pay off that $50,000 at all costs. Your husband should also prioritize his credit-card debt before you do anything — including eating out, going to the movies or the theatre, buying new sneakers (even if they’re on sale), or taking a vacation.

You don’t mention the cause of your husband’s financial infidelity, but unless you deal with this first and foremost, the chances of it happening again are high and/or probable. If he has a gambling problem or a substance misuse issue, for instance, it won’t go away even if you do pay off the debt. Paying off the debt could even provide him with a new impetus to repeat the errors of the past. If this $50,000 debt was news to you, this is a separate problem.