In This Article:

This is The Takeaway from today's Morning Brief, which you can sign up to receive in your inbox every morning along with:

-

The chart of the day

-

What we're watching

-

What we're reading

-

Economic data releases and earnings

Decoding a public company’s earnings report in the 24 hours after its release could be maddening.

Here’s why.

A company that beats on sales and earnings estimates could see its stock pounded after one slip of the tongue from a CEO or CFO on the earnings call (which you can now listen in on with Yahoo Finance). Look at the 20% plunge Gap's (GAP) stock took on Friday after the company reported across-the-board beats but issued a tariff warning many should have seen coming.

Gap CEO Richard Dickson made a compelling case on the state of the business on Yahoo Finance.

A company that misses on sales and earnings estimates could see its stock price skyrocket as analysts and investors reason “bad news” like this was “priced into the stock” months ago. What was not priced in? The positive hype about future growth on the earnings call.

Maddening.

I have generally been on the side of the fence that says companies don’t deserve passes for missed numbers or bad quarters that weren’t properly guided.

The numbers are the numbers. You assess them, crunch them, ponder them further, repeat this process 75 more times, and make a decision on the stock. It's not rocket science.

To that end, I don’t believe AI chip darling Nvidia (NVDA) fully deserves the free pass it got this week for a confusing quarter that was un-Nvidia-like. It reported adjusted earnings per share of $0.81, compared to estimates of $0.93, though the company posted a second (adjusted) EPS figure of $0.96 after excluding "H20 charge and related tax impact."

In other words, the $0.96 figure represents what Nvidia would've made had its China business not gone poof courtesy of Trump's chip export control — a reality that does not exist.

Nvidia has earned a legion of fans on Wall Street through years of strong execution and fundamentals. Analysts have been quick to “exclude” the fall of its once lucrative China business. Every single research note after the results was chock-full of "let's blow more smoke for the Nvidia bulls." Price targets were hiked. All the Nvidia positives were bolded in the PDF docs.

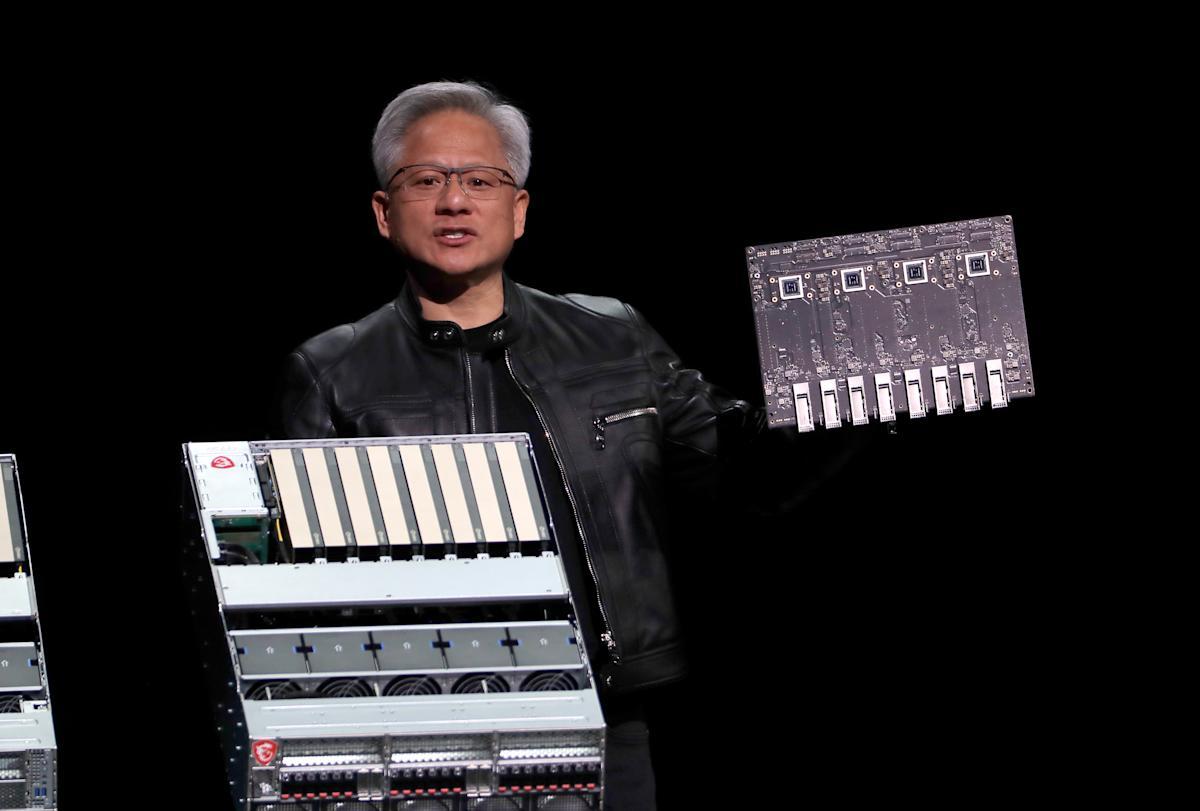

Sure, CEO Jensen Huang made a point to mention on the earnings call that demand for its AI chips remains strong. Profit margins will likely trend back to historically normal levels later this year, CFO Colette Kress said.